Introduction to 'How money impacts mental health'

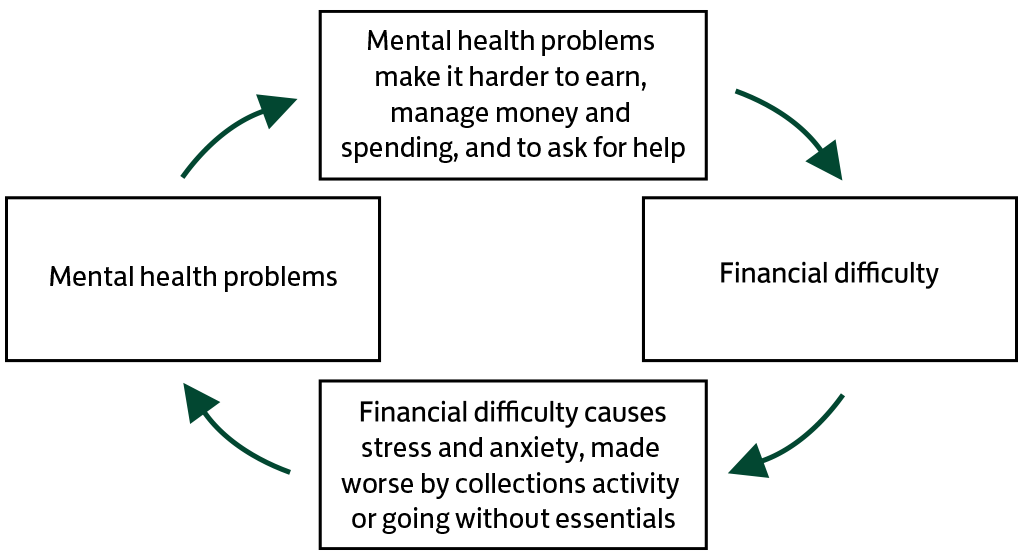

In this lesson, you'll explore how money can impact mental health.

Lloyds Bank Academy is committed to providing information in a way that is accessible and useful for our users. This information, however, is not in any way intended to amount to authority or advice on which reliance should be placed. You should seek professional advice as appropriate and required. Any sites, products or services named in this module are just examples of what's available. Lloyds Bank does not endorse the services they provide. The information in this module was last updated on 26th November 2024.